52+ charitable remainder trust tax deduction calculator

Web Charitable Remainder Annuity Trust Calculator. Web The minimum funding amount for a Harvard-managed charitable remainder trust is 150000 and the minimum age for an income beneficiary is 50 years old.

Understanding Charitable Remainder Trusts Buckley Law

Laird Norton Wealth Management.

. Web The older you are the larger your income tax deduction. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity. We can optimize your wealth transfer strategies.

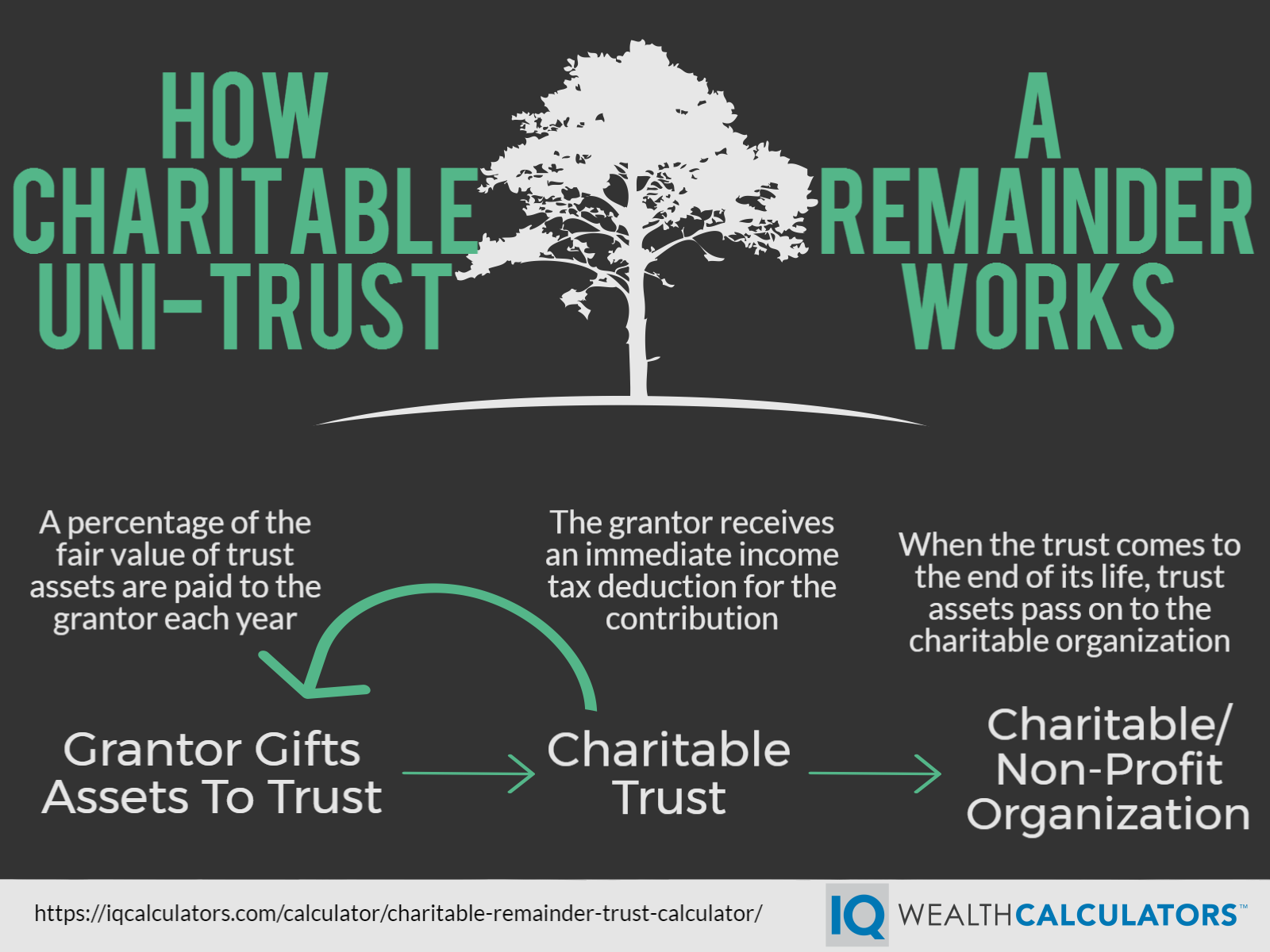

Web Charitable Remainder Unitrust Calculator. Web Contributions to a charitable remainder trust qualify for a partial charitable deduction. Web Charitable Tax Deduction Calculator.

The deduction is limited to the present value of the charitable. Web The calculator below determines the charitable deduction for any of the following gift types. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Generally if the trust is for a term of years rather than for life the income tax deduction will be larger. Learn More At AARP. Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight.

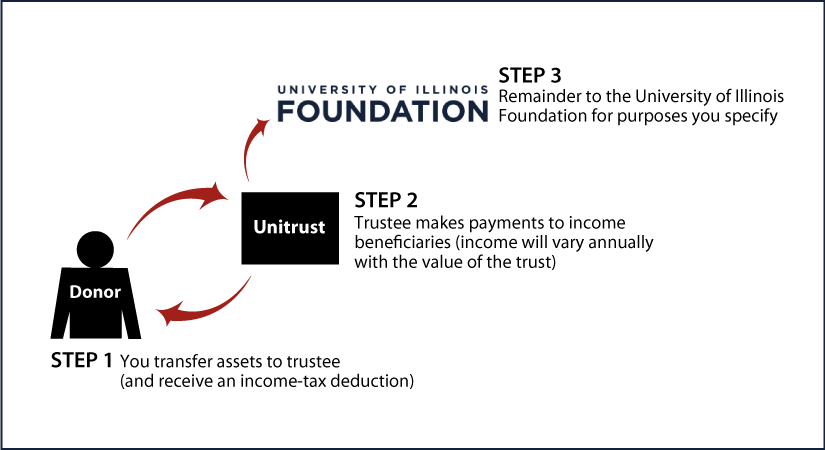

Web Gift Calculator. The donor receives an income stream from the trust for a term of. When a person makes a charitable donation that donation can be deducted from the individuals income.

This will reduce taxes in the tax. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Get started to see how you can save.

Web Also beginning in 2023 taxpayers can make a one-time election of 50000 to use a QCD to fund a Charitable Remainder UniTrust CRUT Charitable. Web The Charitable Giving Tax Savings Calculator demonstrates how you could save on taxes and give more to the causes you care most about. Web The IRS calculates the allowable deduction as the fair market value of the assets placed in the trust minus the income beneficiaries expect to receive as a payout.

Please click the button below to open the calculator. Web That would leave only 20000 of charitable contribution deduction on the account for year 2 and if the trust recognizes a gain in year 2 of 40000 it could again. Web Home Ways to Give Plan Your Legacy Giving That Provides Income Charitable Remainder Trust Charitable Remainder Trust Gift Calculator.

Charitable Gift Annuity Charitable Remainder Trust Pooled Income Fund. Wills Trusts and Annuities. Please click the button below to open the calculator.

Secure Your Wealth Today. If the present value. Web Charitable Remainder Unitrust Calculator A great way to make a gift to Oregon State University Foundation receive payments that may increase over time and defer or.

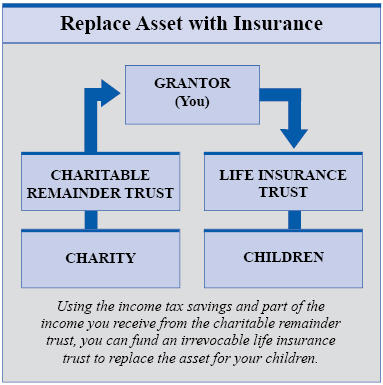

Wills Trusts and Annuities. Web A Charitable Remainder Trust CRT is a gift of cash or other property to an irrevocable trust. Contact your Charitable Estate Planning.

Contact your Charitable Estate Planning. Ad Customized Trust Services For High-Net-Worth Individuals. Learn how to maximize your impact with a Schwab Charitable donor-advised fund.

What Is A Charitable Remainder Trust Carolina Family Estate Planning

Charitable Remainder Annuity Trust Calculator Oregon State University Foundation

Charitable Remainder Trust Calculator

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Remainder Trusts Planned Giving Design Center

University Of Illinois Foundation Gift Planning Charitable Remainder Unitrust

Charitable Remainder Trust Calculator Crt Calculator

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Remainder Trust Calculator

Charitable Giving Tax Savings Calculator Fidelity Charitable

Charitable Remainder Trusts Planned Giving Design Center

Understanding Charitable Remainder Trusts

Charitable Remainder Trusts Planned Giving Design Center

Charitable Remainder Trust Calculator

Charitable Remainder Trust Calculator

Charitable Income Tax Deduction Comparison Calculator Us Charitable Gift Trust

Charitable Remainder Trusts Planned Giving Design Center