Payroll expense calculator

Our employee cost calculator shows you how much they cost after taxes benefits other factors are added up. As a simple rule of thumb.

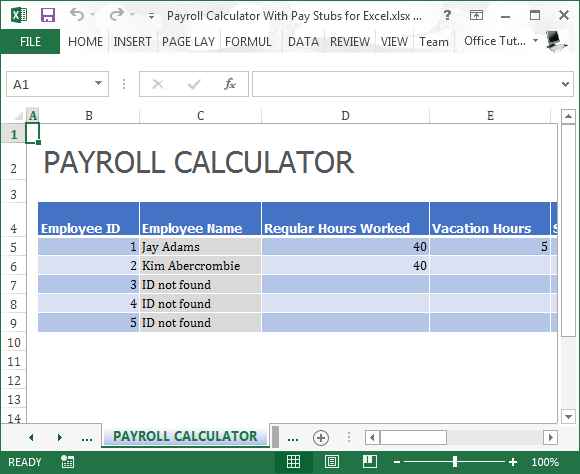

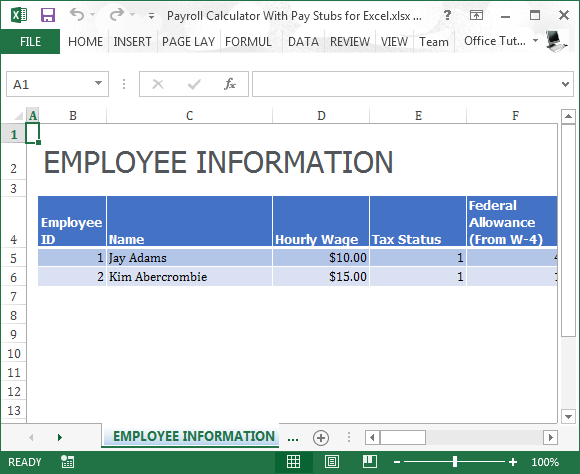

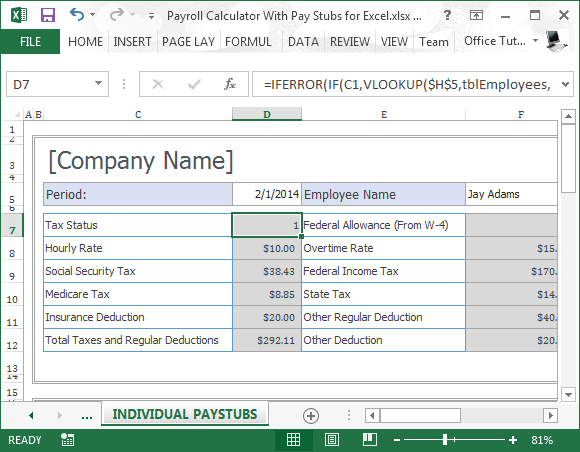

Payroll Calculator With Pay Stubs For Excel

40 hours worked x 14 per hour 560 Lets say that same employee worked 45 hours the following week.

. Per Year Payroll ServicesLicense Charge. Inhouse Payroll Department Costs of Outsourcing your Payroll Current Costs Est. Calculating paychecks and need some help.

Income tax rates vary by state like a flat tax of 307 in Pennsylvania or a tax that. Payroll expenses are the costs associated with hiring employees and independent contractors for your business. Use this calculator to assess the impact that the Off-Payroll IR35 legislation has on your net income.

1950 hours are worked in a year if you work 75 hours per. Rules for calculating payroll taxes. So for someone who is full time making 11 an hour on a biweekly pay.

Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Examples of payment frequencies include biweekly semi.

Employees cost a lot more than their salary. Salary Paycheck and Payroll Calculator. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

To pay workers start with gross pay and deduct withholdings to. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Income Tax formula for old tax regime Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your. Determine how many hours you will work in a year. You may use a common formula.

Payroll Cost Calculator What is your current Payroll operation. Salary Calculator The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Plans Pricing How it Works.

Compute total annual payroll costs. Add Box 1 plus Box 2 plus Box 3 plus Box 4 and enter the Total payroll costs in Box 5. Then you can use the IRS withholding calculator to understand what tax rate to apply for each employee.

Heres a step-by-step guide to walk you through. The Off-Payroll IR35 legislation is a reform to IR35 that was introduced in the public. Gross Pay Calculator Plug in the amount of money youd like to take home.

Step 6 Calculate the average monthly payroll cost. In that instance you would calculate gross pay like this 40 hours worked x. CU Boulder East Campus Administrative and Research Center 3100 Marine Street 4th Floor 579 UCB Boulder CO 80309-0579 accountingcoloradoedu.

Hourly Workers Your manual payroll calculations are based on the pay frequency and their hourly wage. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees. Enter your info to see your.

It only takes a few seconds to.

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

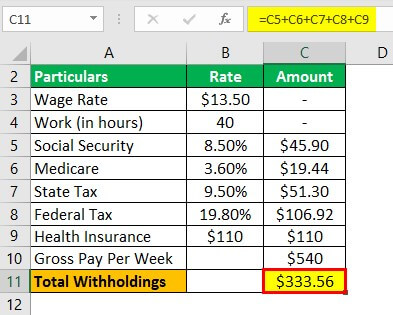

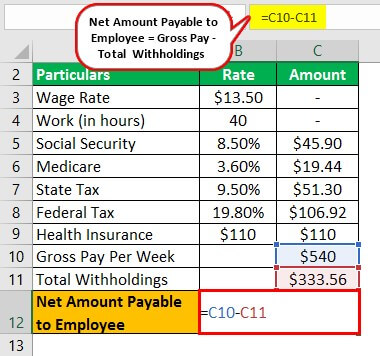

Payroll Formula Step By Step Calculation With Examples

How To Calculate Payroll Taxes Methods Examples More

Payroll Tax Calculator For Employers Gusto

Payroll Calculator With Pay Stubs For Excel

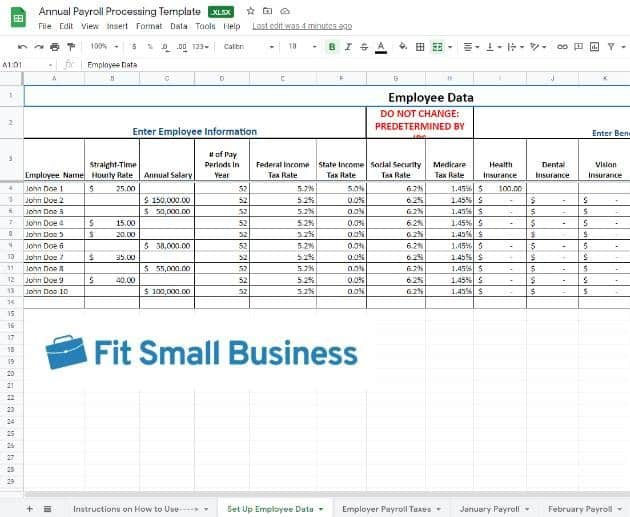

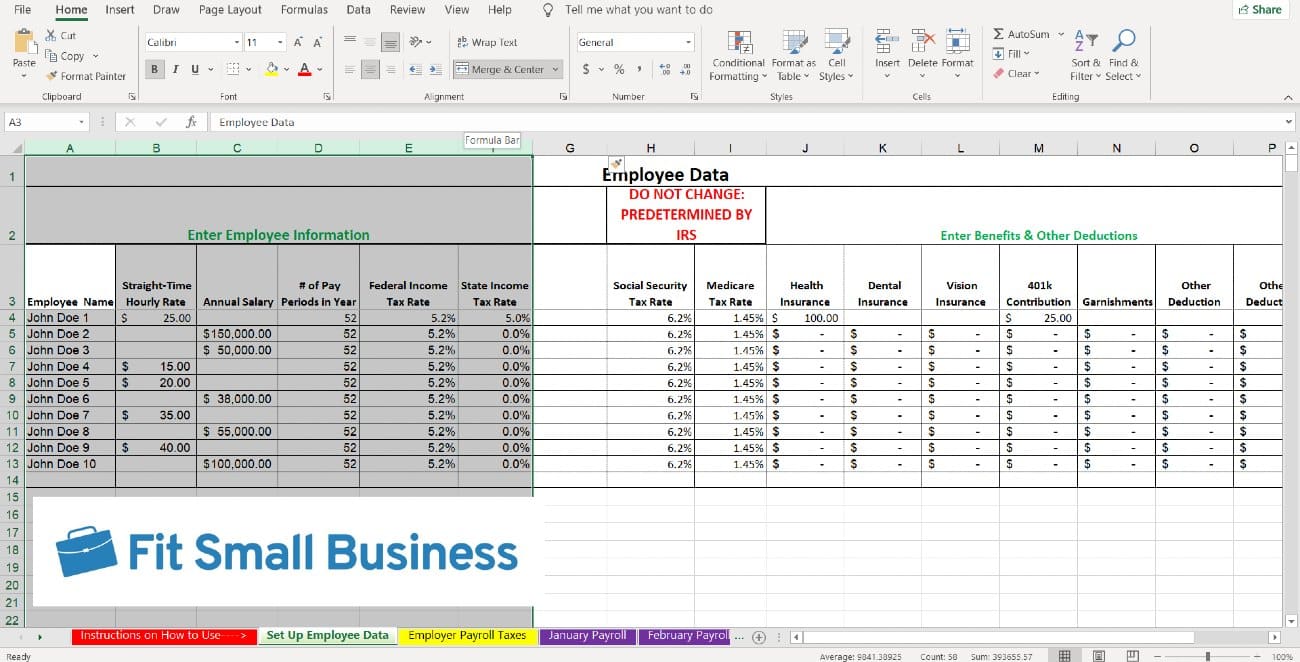

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Federal Income Tax

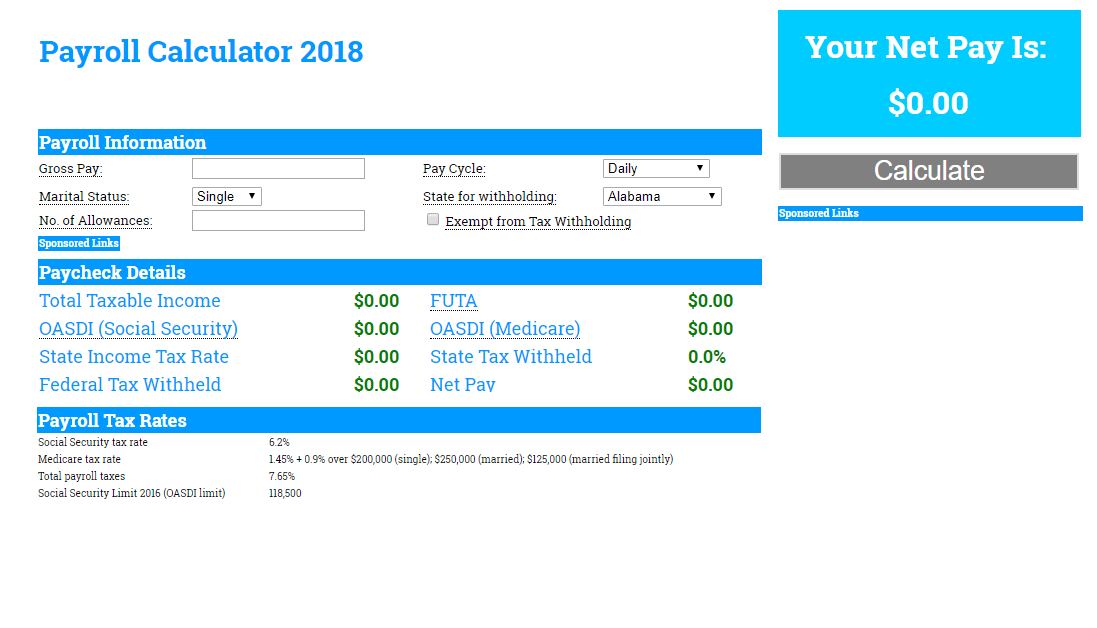

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Payroll Calculator With Pay Stubs For Excel

How To Calculate Payroll Taxes Methods Examples More

How To Do Payroll In Excel In 7 Steps Free Template

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Do Payroll In Excel In 7 Steps Free Template

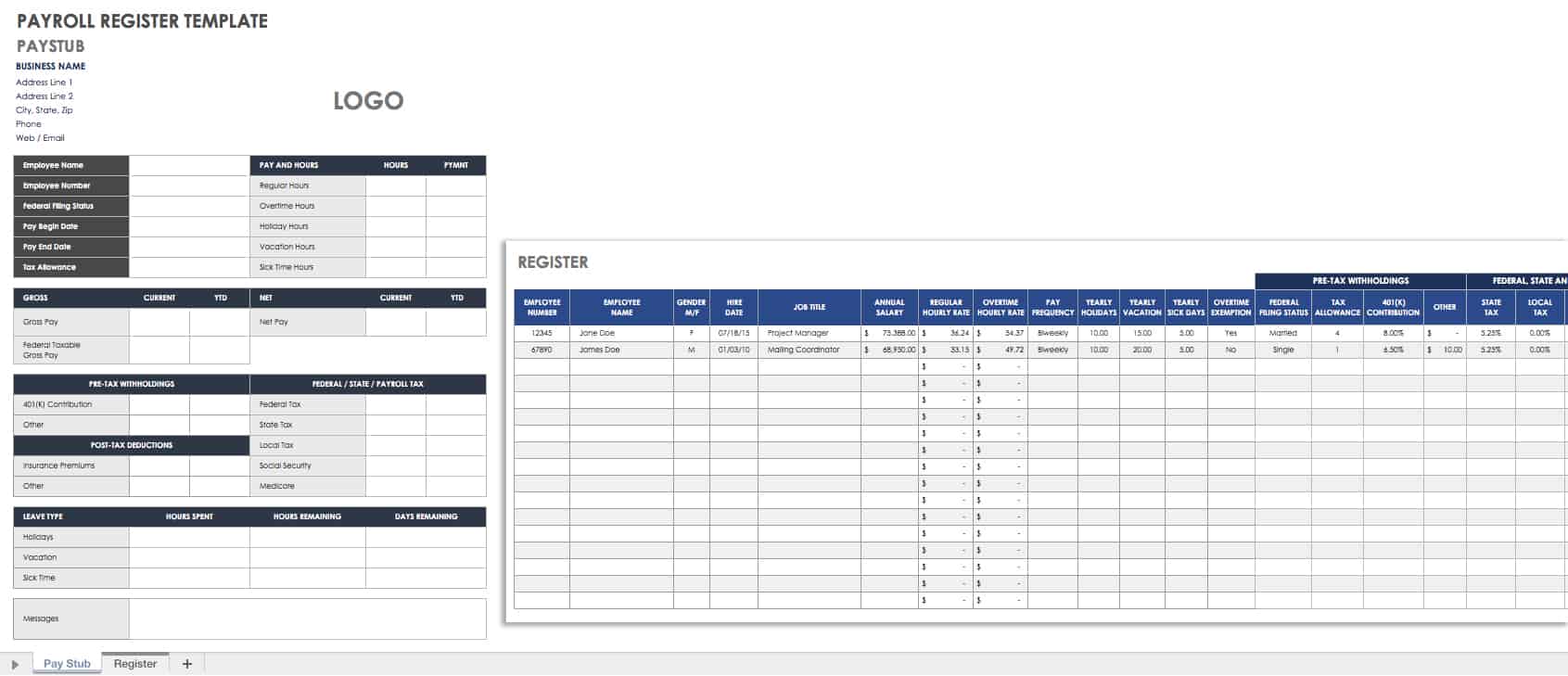

15 Free Payroll Templates Smartsheet

Payroll Formula Step By Step Calculation With Examples

Federal Income Tax Fit Payroll Tax Calculation Youtube